Calculating cost of borrowing

For depreciating assets there are special rules for calculating capital gains the cost. Work out the cost base of an asset including foreign currency and excluded amounts and when not to use the cost base.

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy

Cost of debt refers to the effective rate a company pays on its current debt.

. You claim a deduction for all eligible borrowing expenses for five years or spread it over the term of the loan whichever is shorter. Hence the investors use the following formula to calculate financing costs. An Easy to Borrow or General Collateral Stock.

Federal Student Aid. Say you have 1000 shares of a mutual fund and your lowest-cost shares were purchased for 10 your highest-cost shares were purchased for 100 and your average cost per share is 50. Second mortgage types Lump sum.

There are two factors for daily costrevenues associated with short selling of stocks and bonds at IBKR. Alex is the Borrower the Bank is the Lender. As you can see you can use simple interest to figure out roughly how much youll pay for borrowing money.

The main reason is that the equity shareholders do not receive fixed interest or dividend. Short selling is motivated by the belief that a securitys price will decline enabling it. It is the only company-specific variable in the CAPM.

NO CONTEST 469 Winner take all. Weighted average cost of capital WACC is a calculation of a firms cost of capital in which each category of capital is proportionately weighted. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Without mortgage insurance you may avoid the insurance premium but youll typically pay much higher interest rates and additional administrative fees. The basic services fee includes services that are common to all funerals regardless of the specific arrangement. The Funeral Rule allows funeral providers to charge a basic services fee that customers have to pay.

LIBOR or ICE LIBOR previously BBA LIBOR is a benchmark rate which some of the worlds leading banks charge each other for short-term loans. 1000 10 100. A common mistake when calculating discount rates is using your weighted average cost of capital WACC to determine your discount rate.

For example for a balance over USD 1000000 the first 100000 is charged at the Tier I rate the next 900000 at the Tier II rate etc. Zachs ex-wife Yushea wants him back at any cost. Get 247 customer support help when you place a homework help service order with us.

However if the total deductible borrowing expenses are 100 or less they are fully deductible in the income year you incur them. Cost of a conveyancing kit or a similar cost. In this case the principal balance of 800 becomes 920 over three years.

Short Sale Cost Calculating the Cost of Borrowing Stock at Interactive Brokers. Exhibitionist Voyeur 010820. This can cost around 20208390.

Free calculators for your every need. Calculation of Financing Cost with Examples. This is the wrong approach because WACC includes an equity component and is not specific to the leased asset.

Borrowing expenses such as loan application fees and mortgage discharge fees. Low-cost data bundles and a la carte subscriptions available. 0700 - 2000.

The walls have ears. The borrowing per Startup will be limited to USD 3 million or equivalent per financial year either in INR or any convertible foreign currency or a combination of both. Thin walls at that.

Borrowing expenses are the expenses you incur to take out a loan to buy property. In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before. Exhibitionist Voyeur 122619.

For any expenditure in connection with the business of the borrower. Usually interest rates for finance costs are not published by the Companies. So to borrow the 1000 for 1 year will cost.

In this case the Interest is 100 and the Interest Rate is 10 but people often say 10 Interest without saying Rate. For example a company with a beta of 1 would expect to see future returns in line with the overall stock market. While calculating finance costs is one method to analyze the.

And so this is the normal way. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Be My Guest Ch.

When calculating rates keep in mind that IBKR uses a blended rate based on the tiers below. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Usually borrowing costs are calculated using the Annual Percentage rate APR.

Short Sale Proceeds interest paid to you by IBKR. These include funeral planning securing the. At the end of the day for the vast majority of borrowers the cost of CMHC Mortgage Loan Insurance is more than fully offset by the savings achieved.

An architect can help design the addition and ensure it matches the existing home. What information to give to your treasury department. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future.

Therefore it can be analyzed from the calculation that the cost of capital decreases on borrowing funds from the financial institution. The final calculation in the cost of equity is beta. Outside Regular Trading Hours 11.

Here according to HomeAdvisor are some basic costs you may need to budget for. Be My Guest Ch. Calculating the cost of equity capital is a little difficult as compared to debt capital and preference capital.

Its Khloe versus Heidi to see who screams the loudestthe longestMEN UP. There are special words used when borrowing money as shown here. Preparing the house for the project can cost 12004110 depending on the work required.

Excavation demolition and site preparation. It stands for Intercontinental Exchange London. Beta in the CAPM seeks to quantify a companys expected sensitivity to market changes.

Shall be mutually agreed between the borrower and the lender. Today the market value of your mutual fund shares is. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Weighted Average Cost Of Capital - WACC. Short selling is the sale of a security that is not owned by the seller or that the seller has borrowed. Calculating the incremental borrowing rate.

Calculating the Actual Cost of a Funeral. The definition of all-in-cost prohibiting use of ECB proceeds for payment of interestcharges is not applicable to ECBs raised for project finance and utilised for payment of guarantee fees like ECA Premium and interest during construction provided the said components are part of project cost and capitalised by the borrower.

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

Nearly 70 Of Americans Say Borrowing Money Improved Their Finances Here S How To Avoid Financial Pitfalls Forbes Advisor

Excel Formula Calculate Payment For A Loan Exceljet

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Difference Between Lease And Finance Economics Lessons Accounting And Finance Accounting Basics

Advantages And Disadvantages Of Profitability Index Small Business Accounting Financial Life Hacks Learn Accounting

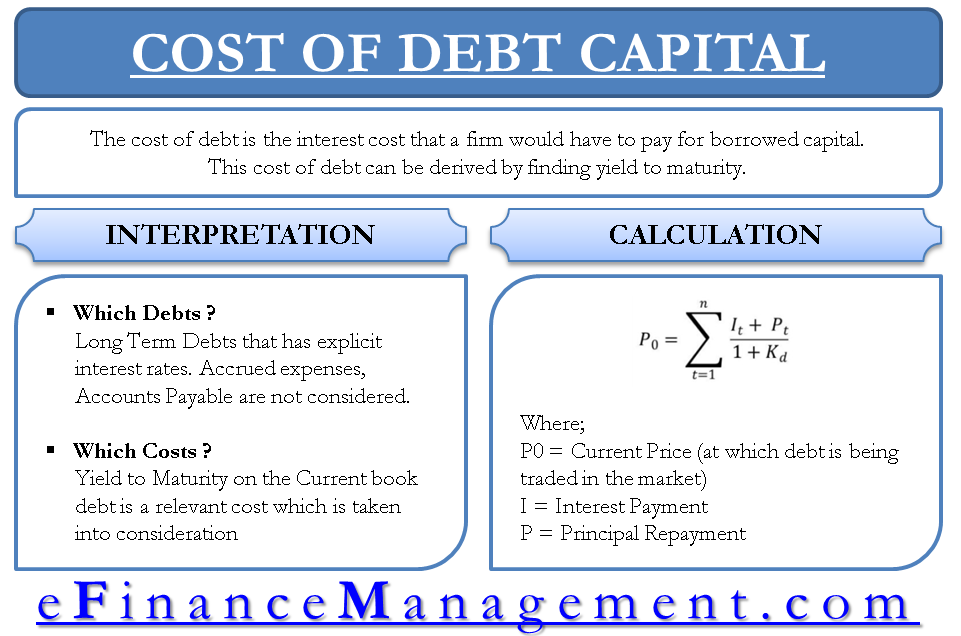

Cost Of Debt Capital For Evaluating New Projects Yield To Maturity In 2022 Accounting Basics Accounting Books Accounting And Finance

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Pin On Business News

Pin By Sh Investments On Random Mortgage Real Estate Information Mortgage Payment

Free Cash Flow To Equity Fcfe Formula And Excel Calculator

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Understand The Total Cost Of Borrowing Wells Fargo

Borrowing Base What It Is How To Calculate It